Demand-Side

Policies

These are policies that aim to influence an economy’s

aggregate demand in order to stabilise the level of output and employment or to

maintain the price level. The 2 policies are fiscal and monetary.

Fiscal

Policy

Fiscal policy is the decisions made by the government on its

expenditure, taxation and borrowing.

An expansionary fiscal policy would be seen as an increase in

government spending or a reduction in taxes that shifts the aggregate demand

curve to the right. A contractionary fiscal policy involves reducing government

spending, usually to below tax revenues.

To the left is a graph showing the macroeconomic equilibrium attained by an expansionary fiscal policy. At AD1LRAS the economy is producing at below full employment level. The government increases its spending and as it is a component of AD it will cause a leftward shift of the AD curve. This creates the new equilibrium of AD2LRAS which more people are employed at, although it does cause some inflation unless we are at the elastic feature of the LRAS curve. The higher the intersect (the more inelastic the LRAS curve becomes) and hence the more inflation occurs along with little growth in employment. To the left is a graph showing the macroeconomic equilibrium attained by an expansionary fiscal policy. At AD1LRAS the economy is producing at below full employment level. The government increases its spending and as it is a component of AD it will cause a leftward shift of the AD curve. This creates the new equilibrium of AD2LRAS which more people are employed at, although it does cause some inflation unless we are at the elastic feature of the LRAS curve. The higher the intersect (the more inelastic the LRAS curve becomes) and hence the more inflation occurs along with little growth in employment.

In this case government expenditure is treated as an

injection into the circular flow, and will be expanded by the multiplier

effect. The higher the multiplier the more effect that government spending will

have, this is dependent on the size of withdrawals from an economy.

When undertaking fiscal policy the balance of payments needs

to be taken into account. Part of an increase in AD is likely to be withdrawn

into spending on imports whereas in the short run there isn’t likely to be an

increase in exports. Therefore in the short run there is likely to be an

increase in the current account deficit on the balance of payments.

The same applies for a contractionary fiscal policy where

there is likely to be a leftward shift of the AD curve which will cause a fall

in the increase of prices and will cause lower overall employment.

The government budget deficit or surplus (the difference

between government expenditure and revenue (taxation)) also needs to be taken

into account when deciding on a fiscal policy. By undertaking an expansionary

fiscal policy the budget surplus is likely to decrease (if expenditure

overtakes revenue) or the deficit will increase, and vice versa for a

contractionary policy. However to a certain extent, the government budget

deficit changes automatically without intervention from the government.

If the economy goes into a recession then unemployment benefit

payments will rise thus increasing government expenditure and simultaneously

tax revenues will fall as less people are paying income tax as they are out of

work. VAT recipes will also fall if people are spending less on goods and

services.

The opposite effects will be evident in a period of boom,

preventing the economy from overheating. Automatic stabilisers are initiated

during either a boom or a recession. An automatic stabiliser is an effect by

which government expenditure adjusts to offset the effects of recession and

boom without the need for active intervention. Therefore government expenditure

automatically rises during a recession and falls during a boom.

Governments may use fiscal policy in a discretionary (at

their own will) way in order to influence the path of an economy. A government

might use its discretion to increase government expenditure to prevent a

recession. Such intervention has been shown to be damaging to the long-run path

of the economy because of its effects on inflation.

Monetary

Policy

Monetary Policy is an approach used to stabilise the

macro-economy. It entails the use of monetary variables such as money supply

and interest rates to influence aggregate demand.

The prime instrument of monetary policy is the interest rate. At higher interest rates, firms undertake less investment expenditure and households consume less. Therefore inflation will fall (or won’t continue to rise). An example of this is if the economy is close to full employment. From the graph we can see that if the economy continues to grow (this will cause a rightward shift of the AD curve) the new equilibrium point will be on the 3rd feature of the LRAS curve. This is the inelastic point where the economy is at full employment and the maximum amount of overtime is being used. Therefore any further growth will cause inflation (from the inelastic point on the LRAS curve) but won’t produce any extreme output or employment. The prime instrument of monetary policy is the interest rate. At higher interest rates, firms undertake less investment expenditure and households consume less. Therefore inflation will fall (or won’t continue to rise). An example of this is if the economy is close to full employment. From the graph we can see that if the economy continues to grow (this will cause a rightward shift of the AD curve) the new equilibrium point will be on the 3rd feature of the LRAS curve. This is the inelastic point where the economy is at full employment and the maximum amount of overtime is being used. Therefore any further growth will cause inflation (from the inelastic point on the LRAS curve) but won’t produce any extreme output or employment.

Therefore monetary policy might be to increase the base rate

so to lower demand, and hence prevent the economy from overheating.

The responsibility of monetary policy is in the hands of the

Bank of England where a Monetary Policy Committee (MPC) has the use of the

monetary instruments to control inflation. The government set the inflation

target at 2% p/a as measured by CPI. This is within a range of ±1%, if it exceeds this or falls

below this then the Governor of the BoE has to send an open letter to the

Chancellor of the Exchequer explaining why this is the case.

The MPC sets the base rate at which they pay interest on

commercial bank reserves. The commercial banks then use this base rate to

calculate their own interest rates for domestic borrowers. Therefore if the BoE

were to change the base rate then the commercial banks would likely follow

suit.

The

Transmission Mechanism

The official rate is the base rate set by the MPC at the BoE. These affect the market rates (commercial bank interest rates), asset prices, confidence and the exchange rate.

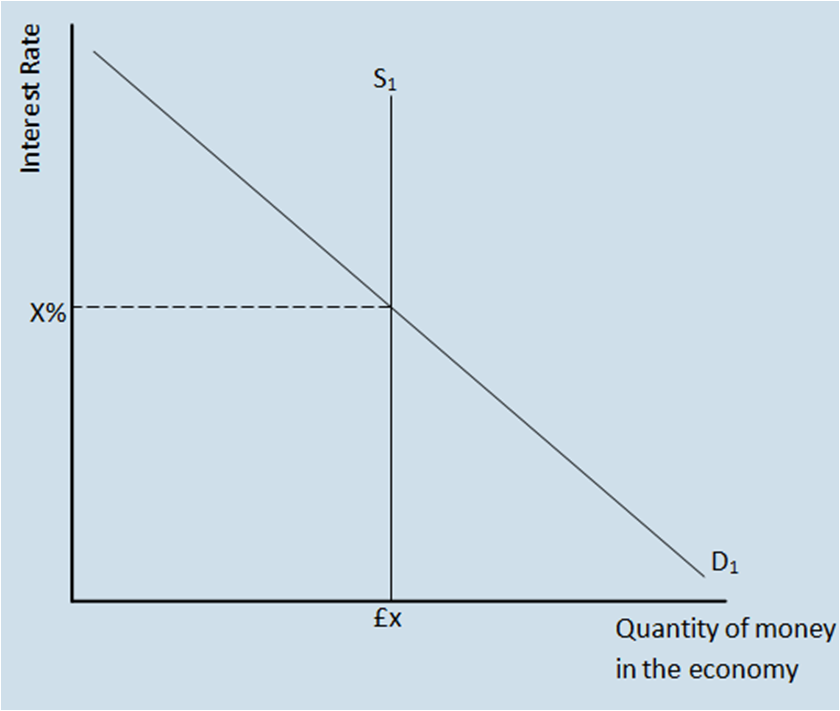

The market rate is affected because it will always be above the base rate, the amount higher it, is dependent on the risk factor and demand and supply. If there is high demand to borrow money (lots of people need cash) and there is low supply (people don’t want to lend) then market rates will be high, and vice versa. This is shown below on a money market loan-able fund graph:

The graph above shows that it isn’t possible to control money

supply and interest rates simultaneously and independently. If the quantity of

money (supply) was to increase then interest rates would automatically fall. NB: Interest rates are market rates but the

base rate should be similar.

The base rate will affect expectations and confidence. If one

is unemployed and the base rate is about to rise one may believe that

businesses will invest less and one would remain unemployed. Therefore one’s

spending habits will change and one is more likely to save rather than spend

which will reduce AD.

People on variable loans/mortgages may have to pay more if

the base rate rises, however those on a fixed rate won’t be affected. Savers

may be happy about a rise in the base rate and so will be confident about the

future. In evaluation, the effects on AD due to confidence levels may take time

to filter through the economy.

If the base rate is increased then the exchange rate may

increase due to increased foreign investment. This means that sterling will be

strong against other currencies which may be bad for the economy as exports are

likely to fall (as they become more expensive for foreign consumers) and

imports may increase (as they become cheaper for consumers) thus affecting AD.

All of these affects affect the components of aggregate

demand and lead to inflation. If base rates fall then inflation is likely to

rise as AD should increase (this would be demand-push inflation) and conversely

if base rates rise then inflation is likely to fall as AD falls (people are

putting their money in savings and businesses aren’t investing).

Page last updated on 20/10/13

|