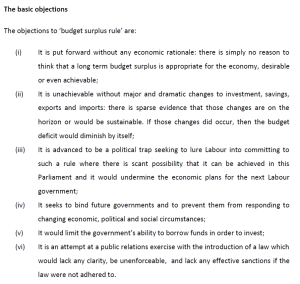

I’ve just finished reading Malcolm Sawyer’s take on budgets surpluses (Malcolm Sawyer – Budget 2015 The budget surplus – see image for his basic objections) which leads be to write the following post, questioning whether budget surpluses are as positive as Osborne would have the public believe.

I’ve just finished reading Malcolm Sawyer’s take on budgets surpluses (Malcolm Sawyer – Budget 2015 The budget surplus – see image for his basic objections) which leads be to write the following post, questioning whether budget surpluses are as positive as Osborne would have the public believe.

A government’s fiscal situation and that of an individual, or even a firm, are completely different. When a government decides to borrow then it must be the case that the private sector is saving, and when the government decides to save then it must be the case that the private sector is borrowing. It is also the case that a government’s decision to borrow or save can affect the level of employment and thus cause misery through this channel: a government running a budget surplus may deprive the economy of demand which could cause higher unemployment. However, one could contend that by running a budget surplus (i.e. saving more tax revenues than it spends) that the government is lowering the interest rate which should mean higher investment and consumption as it is cheaper to borrow thus replacing the need for government spending. If it is the case that interest rates are lowered by so much that the increased consumption and investment completely replaces the money the government would have spent then it would make no difference whether it was the public or private sector doing the spending. This would simply be a matter of political persuasion as to whether the government should be spending rather than the private spending. In reality, Keynesians believe that the government has a fiscal multiplier: spending £1 boosts GDP by more than £1.

Furthermore, the government may be spending money on investment or public goods. Remember that public goods are those which have positive spillover effects but the private benefit is lower than the public benefit such that the private sector wouldn’t provide them (e.g. education, street lights, defence). If the government is spending money on goods which will boost the size of the economy in the future (think rightward left of the long run aggregate supply curve), then it may be worth running a budget surplus and incurring slightly higher interest rates. In the current climate, with interest rates so low, it is unlikely that more government spending would alter rates by much. In fact, it may even be the case that markets see the government is spending more on the future capacity of the economy, realise that GDP will be higher in the future, so tax revenues will be higher and the government will easily be able to repay its debt, leading to lower borrowing rates for the government!

Sawyer highlights the fact that a budget surplus is usually defined over a time period which is vague. The rule would constrain the government to maintain a balance/surplus in normal economic times over the business cycle. Firstly, the business cycle is quite vague and difficult to determine. Moreover, how does one define “normal economic times”. The economy is constantly changing and evolving that there could be an argument that there is never a normal time for an economy. Take the current period for example, Britain is doing fairly well – at least relative to other OECD countries – is this considered a normal time? One could counter-argue that the artificially low interest rates and the global situation means it isn’t.

Budget deficits and surpluses, in most cases don’t arise from discretionary spending but through automatic stabilisers. During bad times tax revenue falls and social security spending increases. Therefore to ensure a budget surplus it might be necessary to increase taxes or reduce welfare spending (the Conservative’s favour the latter), but this would exacerbate any economic downturn. Since 1950 there have only been 7 years in which the UK has maintained a budget surplus, 5 of them were when Labour was in power (Sawyer), this hardly helps Osborne’s point that the Labour party are economically incompetent, although it is the size of the surplus which matters the most.

With the advent of Private Finance Initiatives (PFI) budget rules become redundant. A government can increase spending whilst maintaining a budget balance/surplus, simply by engaging in PFIs which would pass on debt to future generations (and become future politicians’ problem) and make the rule unsustainable. Therefore, if Osborne was serious about a budget rule he would ensure that this loophole be closed.

So then, what is the point in a budget rule? Well, the only realistic argument is political rather than economical – Osborne wishes to gain political points by showing that his government is credible on the economy, especially as public opinion is, generally, currently pro-austerity. This may force Labour to accept such a rule, otherwise they would be portrayed as fiscally reckless, especially after presiding over the Great Recession (not that it was their fault!).

In conclusion, it is not the case that a budget surplus is undesirable, just that it isn’t suitable for the economy in all times and places. The budget ought to be flexible so it can respond to changes in the economy to minimise fluctuations and suffering. Such a clumsy rule as currently proposed would damage the economy, and its only purpose would be to attempt to gain political points based on a false belief that the government should minimise spending.