Day 1 – Talk 2

After our Introduction to Post-Keynesianism from Engelbert Stockhammer we were given a talk by Ozlem Onaran, from Greenwich University, on “Aggregate demand, income distribution and unemployment”.

She begins by adding to Engelbert’s introduction, highlighting that fundamental uncertainty can lead to path dependency – that is decisions made today (as a result of fundamental uncertainty) will have knock-on effects into the future. Post-Keynesians believe that full-employment is a special scenario, unlike neo-classicalists who believe that full-employment is the natural equilibrium and deviations are temporary and as a result of external shocks.

The determinants of investment are reminded as: capacity utilisation (how much of existing machinery is being used), credit availability, animal spirits, technological opportunities (after WWII there were many new technologies – partially discovered/created through military efforts – which helped aid the post-war boom as firms rushed to invest in these new technologies to make profit from them) and future profitability.

Unemployment in a classical story only arises through voluntary decisions not to remain employed at the prevailing wage. For classicalists if a shock occurs then unemployment may initially rise but this should put downward pressure on wages, so that employment then returns to it’s normal equilibrium. If people refuse to accept lower wages then this must be a voluntary choice not to work – perhaps because at the wage rate the opportunity cost of working v.s. leisure means that these people would prefer to enjoy leisure, it must assume that these workers have sufficient savings, or alternative income, to enjoy leisure and not work. Keynes disagrees and believes that unemployment isn’t voluntary and believes that unemployment is due to a lack of aggregate demand and explains why the government should step in to increase demand whilst the economy is in a slump (this has the added benefit of preventing hysteresis channels). There are a variety of reasons why nominal wages may not fall – contracts prevent this happening in the short run, firms may be scared of demotivating the workforce for fear of lower productivity, trade unions create an insider-outsider effect, and government benefit schemes and national minimum wages act as a floor. It could be argued that firms could leave existing workers wages as they are in nominal terms (so this will be eroded at in real terms providing there is inflation) and then offer a lower wage to new workers (but this assumes that the firm is taking on employees when it is likely laying them off). However, behavioural economics shows that people see different wages for the same job as unfair, and this could have a negative effect on productivity or on brand image.

There are also cyclical hypothesis for unemployment, such as the Goodwin cycle. This goes as follows:

Larger reserve army of unemployed workers means low wages and high profit margins (note: we are talking about margins here, not overall profit because consumption is likely to be depressed as a result of the low wages and high unemployment) but little investment realisation due to underconsumption which means low estimates of future profitability.

Eventually investment grows due to the low costs (e.g. wages and other resources which have had their prices depressed) and high profit margins

This high growth depletes the reserve army, squeezing profits (higher wages) which lowers investment and the cycle begins again.

Unfortunately this model has a couple of flaws: firstly, it assumes that firms accept higher profit margins and don’t lower the price of their goods to sell more. If this were to happen then investment may occur more quickly because future expected profitability should be higher as output is greater, albeit with a lower actual profit margin. Secondly, there is the assumption that lower investment will cause an increase in employment. But this would only occur if a sizeable amount of the workforce was employed in construction and the creation of capital goods. If construction was a small part of the economy and most capital goods were imported then a fall in investment shouldn’t necessarily lead to increases in employment.

Moving on to wage and profit shares, it is noted that wage share falls usually arise due to wage moderation, as oppose to an absolute decline in nominal wages. By definition a falling wage share means an increasing profit share. Neoclassicals would believe that this increase in profit share would lead to an increase in investment and also export increases. Exports may rise because, as we have already said, the falling wage share means falling real wages, and hence lower costs. Domestic goods will then fall in price due to the fall in costs, meaning higher profit margins/shares and greater international competitiveness. Cheaper domestic goods should mean increased demand for foreigners, thus providing an export boost.

Obviously, the size of the investment and export effects depends on the sensitivity to profit margins and price elasticity of exports, it is also likely that an increase in international competitiveness would eventually alter the exchange rate – if floating – such that we only see a short lived export boom. Globalisation means there may be no boost to international competitiveness, as countries engage in a race-to-the-bottom, to lower wage shares as much as possible in order to benefit from growth, as a result no country sees an export boost and the negative effects of a falling wage share (highlighted below) prevail.

Contrary to the neoclassical story, Keynes would argue that consumption would fall – because people have lower real wages – which may reduce the benefits to greater exports and higher investment. Furthermore, lower consumption could reduce incentive to invest, as productive capital would be underutilised. Keynes’ investment function is dependent on animal spirits and demand for the good, rather than on profit margins and interest rates. In addition, Keynesians believe that workers have a greater MPC (marginal propensity to consume) than capitalists, so if workers see their income share fall whilst capitalists see theirs rise, then we would expect to see a net reduction in national income. It is worth noting that in the last few decades profit share has been increasing, yet growth has been falling.

Bhaduri and Marglin (1990) stipulate that if profit share increases and the total effect is a fall in aggregate demand, then our economy is characterised as being wage-led, if we have a positive increase in aggregate demand then we have a profit-led economy.

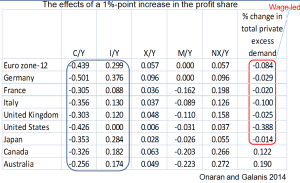

In a recent paper Onaran and Galanis (2014) evaluate the effect of a 1 percentage point increase in profit share, to see the effects on a variety of variables for different developed countries (UK, USA, Germany, France, Italy, Japan, Canada and Australia). They find that consumption fell in all these countries, whilst investment rose: but in no country studied did it increase greater than consumption fell. In all countries there was an increase in net exports but the overall net effect of a 1 percentage point increase in profit share was negative in all studied countries bar Australia and Canada.

They postulate that the reason the US I/Y share remains at 0 is because profits are re-distributed back to shareholders. Therefore a 1% point increase in the profit share doesn’t lead to higher investment as more money is returned to shareholders in the form of higher interest payments, larger dividends and share buy-backs. In conclusion they find that the global economy is wage-led and a 1% point fall in the wage share simultaneously occurring as profit share increases by 1% point leads to a fall in global GDP of 0.36%. This leads to an overall conclusion that increasing profit shares and rising inequality, which have been a feature of developed economies in recent years, has a negative effect on GDP, contrary to a neo-classical story.

Relating her research to Greece she finds that exports aren’t very sensitive to wage costs and imports are completely unresponsive. Therefore falling wage shares would cause balance of payment problems and believes the only reason the current account deficit can be maintained is because output (Y) fell so significantly.

You can view Ozlem’s Presentation here – Aggregate Demand, Income Distribution and Unemployment

Day 1 – Talk 3

Our third presentation was given by Victoria Chick, a co-founder of the Post-Keynesian Study Group, on Money in the economy. The talk highlights the role money plays as a liquid and safe asset, it is used by people as insurance because of its liquidity, but it introduces uncertainty (e.g. a firm can’t be sure that savings will be spent on its products). When we talk about money we mean cash and coins which people store at home, not electronic deposits stored in a bank.

This leads us to a discussion on how Keynes believed interest rates were set: by the liquidity theory of money. People hold money because they wish to conduct transactions (transaction motive), for precaution, or speculation: they believe the rate of return on cash will be greater than other assets. If more people wish to hold money then there must be less savings in the bank, to offer an incentive to save banks will increase their interest rates. Therefore, greater demand for money ==> higher interest rate.

The interest rate is important as it is a function of investment (as are other variables, and some Post-Keynesians would dispute the size of the role that interest rates play on investment) – a lower interest rate means it is cheaper to invest so investment should rise. Hence the interest rate plays a role in determining the limit to the level of employment.

Next we move on to a Post-Keynesian view of how money is created. Neo-classicalists would believe that money is created exogenously by the central bank, whereas the PK story is that it is created endogenously by commercial banks. If we look at a banks balance sheet we find that its assets are its loans and liquid securities, whilst its liabilities are its equity capital and deposits. Liquid securities could include government bonds and cash held with the central bank, whilst equity capital is the amount of money put into the bank by its owners. Banks can create money because of fractional-reserve banking. In most economies, a bank doesn’t have to keep 100% of deposits as reserves. A deposit is the money ordinary people “save” in a bank and the reserves is the money kept in the banks’ vaults (usually with the central bank). If I lend a bank £100 it doesn’t normally have to store that £100 in reserves but can often lend out a percentage. Say we live in a country which has a reserve-deposit ratio of 10% then the bank would have to keep £10 in reserves and could lend out the remaining £90 of my savings. I still have £100 but there now exists an additional £90 in the economy because the bank has lent this to a shop-owner to expand his shop. So our economy, which went from being valued at £100 is now worth £190. But lets say our shop-owner purchases the larger shop from a property owner who then puts that £90 into the bank. The bank could then lend out another £81 (with £9 in reserves), so our economy is now worth £100+£90+£81 = £271. This cycle will continue but because of fractional-reserve lending the amount of money in the system would equal £1000 [this comes from the formula of the sum of an infinite geometric progression: a/(1-r)]. This is why PK believe that money is created endogenously – because it is part of the system under fractional-reserve banking. They don’t believe that central banks efforts to increase the money supply are as effective, or important. In the panel discussion that followed her talk, Chick pointed out that 97% of all new money supply is created by commercial banks.

You can view Victoria’s Presentation here – Victoria Chick

Devrim Yilmaz – Minsky, Instability and Financial Regulation

The final economics talk of the event – there were other Marxist economy and panel discussions which aren’t mentioned here – was given by Professor Yilmaz on the financial sector and the work of Hyman Minsky.

Minsky argues that crises are endogenous to the capitalist system which differs from a Smithian view that free markets are efficient and socially optimal.

We start by pointing out that every financial unit has assets and liabilities with varying characteristics with the respect to liquidity and maturity. He identifies 3 categories of financial units: hedge finance, speculative finance and Ponzi finance.

Hedge finance is a strong position which does not require buying and selling of assets or borrow and lending due to shortages in cash flows as such a unit has large cash flows from its operations and/or large cash reserves.

Speculative financial units have cash flows which meet interest payments on outstanding debt but requires rolling over debt, or liquidation of assets to meet cash flows.

Ponzi finance is a situation where cash flows do not meet interest payments on outstanding debt and hence depends upon a continuous increase in asset prices to remain in existence. Without an increase in asset prices a rapid liquidation of assets would ensue.

The first theorem of Minsky’s Financial Instability Hypothesis is that the economy will be sustainable if hedge units dominate within the system. More speculative and Ponzi units increase instability and risk.

The second theorem states that over long periods of time, economic units progress from being hedge units, to speculative and Ponzi units. This arises from a view of Keynes that speculation will lead to over-investment which causes the economy to overheat, pushing up aggregate demand and causing inflation. The central bank responds to this by increasing the interest rate to reduce inflationary pressures. A higher interest rate pushes economic units from hedge to speculative and from speculative to Ponzi financing because financial agents have lower profit margins.

This higher interest rate – along with the shift towards more speculative/Ponzi units – means units with a shortfall of cash will make up for this by selling assets. If enough agents in the economy have cash-shortfalls, and need to liquidate assets then fire-sales may follow. A firesale occurs when lots of units are selling assets, driving their prices downwards (perhaps below a “fair” value) and meaning that more units have to sell further assets to prevent themselves becoming insolvent. This could lead to a Fisher debt-deflation spiral.

Minsky Cycles and Moments

The margin of safety for a firm is the excess of future cash-flows from income-generating assets/production over cash-outflows of liabilities. This is the buffer zone which protects against the need to borrow or liquidate assets. During stable economic times, margins of safety are reduced: stability is destabilising. This is not necessarily due to confidence or euphoria, but because lending models are typically back-ward looking, so if the economy has experienced stability for the last 5 years then most models – and agents’ memories – will remember this stability and so expect the probability of default to be low. Agents within the system are unaware of the declining margins of safety. This increases lending to previously declined projects, which were deemed too risky, which can lead to asset-bubbles and an increase in the number of Ponzi agents.

Eventually a moment will arise when asset prices stop rising, Ponzi units face problems of financing cash flows on debt commitments and the fire sale of assets occurs: the market crashes. This is the end of the Minsky cycle and is known as a Minsky moment. Davidson (2008) defines a Minsky moment as “when the Ponzi pyramid financial scheme collapses” whilst Lahart (2007) believes it is “when over-indebted investors are forced to sell even their solid investments”.

Some may assume that the Great Recession was a Minsky moment, but Kregel (2008) claims it was not because there was no gradual decline in the margin of safety, but an instantaneous crash. There is a belief that in recent times, units were being created which were Ponzi units with no margin of safety nor history of stability, seeing as they had just emerged in 2003, right after the dot-com bubble.

Minsky and Ferri added further to this initial theory by using “thwarting systems” to explain why instability wasn’t more prevalent. They wrote that customs, institutions and policy intervention caused limits to how low an economy fell. Even the belief that institutions such as the government, or the central bank (often the lender of last resort), would not let a calamity occur can be stabilising and create a self-fulfilling prophesy. However, eventually every economic unit becomes aware of these thwarting systems and adjusts its behaviours to maximise returns based on this system. For example, the central banks role as a lender of last resort is a thwarting system which can prevent a calamity as agents realise they could be saved, and so fears of insolvency may not be necessary. Yet eventually firms become aware of this, and hence take risky action to profit-maximise, knowing that if they fail they will be bailed out.

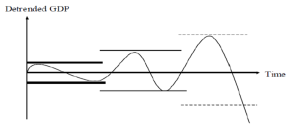

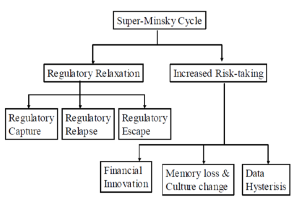

Palley (2009) claims that the credit crunch was the end of a Minsky Super-Cycle. Such a cycle includes a series of normal Minsky cycles but ends when the thwarting mechanism is exhausted. It occurs over long periods of time and starts with regulation, moves to regulatory relapse before regulatory escape and eventually the bursting of the super Minsky cycle and a return to the beginning of the cycle. Regulation occurs when the government intervenes through regulation to reduce profits for financial institutions, perhaps by limiting their activities, or increasing their liquidty ratios. Regulatory relapse occurs when regulation is eased, perhaps due to lobbying by financial institutions and periods of stability which make economic agents forget about the dangers of unregulated activity. Regulatory escape is the culmination of this easing whereby financial institutions are free to do what they want. At the end of a super-cycle, when the thwarting mechanism has been exhausted, we return to a situation of regulation.

Throughout the occurence of this super cycle, ordinary Minsky cycles can occur but the range of fluctuations during this regular Minsky cycles increase as economic agents expand to overcome the thwarting systems to increase profits. It is important to remember that it is only the floors and ceilings which are changing whilst individual recessions can be stronger or weaker depending upon the situation.

The increased risk taking is also increased by data hysteresis (recent data shows period of stability), memory loss, culture change and financial innovation to maximise profits and overcome regulatory restraints.

Not all Post-Keynesians believe in these super-cycles as put forward by Palley. At any rate, it could be argued that we haven’t yet come to the end of the super-cycle (because we haven’t returned to a situation of regulatory control) which would suggest – according to this theory – that the next crash will be even larger. This might be justified by a belief that banks realise they are too big to fail, and having witnessed the enormous bail-outs of the 2007 Crash, increase risk-taking to maximise profits. On the other hand, some could argued that culture has changed within the financial system and the regulators are more vigilant, despite the lack of increase formal regulation.

In a Minskian framework we can prevent financial instability by detecting and preventing Ponzi finance. The framework also suggests that we should reduce financial competition and innovation, which is often developed to overcome regulation and confuse regulators. In direct contrast to what is proposed by neoliberalists (see the Efficient Market Hypothesis below).

You can read more on Minsky here.

The Efficient Market Hypothesis

This is the belief that asset prices contain all possible public knowledge about the security (asset) and any new information will be reflected in the price almost instantaneously. This therefore implies it is impossible to outperform the market consistently. Yet, as Devrim points out, last year JP Morgan had no trading losses on a day-to-day basis: it seemed to have consistently beaten the market. This is similar to the idea of a random walk which says that it is not possible to predict future asset prices based on past prices.

This theory allows some to believe that financial markets are efficient and promote stability. This differs from the Minskian view, and instead attributes financial instability to imperfections in the market, such as government intervention, asymmetric information and moral hazard. There is a belief that greater competition is required, and less government intervention. Shiller (2001) believes that greater education about finance needs to be given to ordinary people, to increase competitiveness and also that new indices (which track a bundle of selected assets) need to be developed.

You can view Devrim’s Presentation here – Post-Keynesian Workshop Presentation

Reading List

Below is a reading list set by each speaker based on their topic/interests around Post-Keynesianism

Engelbert Stockhammer

Keynes (1936): The state of long term expectation (Chapter 12 of General Theory of employment, interest and money)

Keynes (1936): Changes in money wages (Chapter 19 of General Theory of employment, interest and money)

Kalecki (1965): Theory of Economic Dynamics, chap 1-3

Sawyer (1996): Post-Keynesian macroeconomics (A Guide to Modern Economics)

Lavoie (1992): Foundations of Post-Keynesian Economic Analysis

King (2002): A History of Post Keynesian Economics since 1936

Ozlem Onaran

Bhaduri and Marglin (1990): Unemployment and the real wage: the economic basis for contesting political ideologies

Hein: Distribution and Growth after Keynes: A Post-Keynesian Guide

Onaran and Galanis (2014): Income distribution and aggregate demand: National and global effects (Here)

Kalecki – Political Aspects of Full Employment (http://mrzine.monthlyreview.org/2010/kalecki220510.html)

Victoria Chick

Cardim de Carvalho (1992): Mr Keynes and the Post Keynesians

Greenham, Ryan-Collins and Werner: Where does Money Come From?

Bibow: On exogenous money and bank behaviour: the Pandora’s box kept shut in Keynes; theory of liquidity preference

Dow: Endogenous Money (Chapter 28 in Harcout and Riach: The General Theory)

Minsky (1992): The financial instability hypothesis

Devrim Yilmaz

Crotty (1986): Marx, Keynes and Minsky on the Instability of the Capitalist Growth Process and the Nature of Government Economic Policy in “Marx, Keynes and Schumpeter: A Centenary Celebration of Dissent”

Minsky (1992): The financial instability hypothesis

Minsky (1986): Stabilizing an Unstable Economy

Palley (2009): A Theory of Minsky Super-Cycles and Financial Crises

Tymoigne (2011): Financial Stability, Regulatory Buffers and Economic Growth: Some Post-recession Regulatory Implications